Region: India

Scope: Multi-site inspection and market valuation of gas-fired power assets

Capacity: 1,935 MW combined cycle

Date: December 2016

Overview

In December 2016, CESS was appointed by a private infrastructure group to conduct a market-based valuation of a 1,935 MW portfolio of gas-fired power generation assets located across four Indian states. The portfolio included mothballed, operational and unused plants, with a broad range of OEM technologies; from aero-derivative LM6000s and GE Frame 6B units to Siemens V94.2 and unused GE Frame 9FA combined cycle blocks.

Execution Timeline

The scope and speed of execution were defining features of this assignment. Covering nearly 2 GW across four geographically dispersed sites, CESS deployed senior engineers to complete all on-site inspections within one week of contract execution.

A full valuation report was then delivered just two weeks after appointment, demonstrating CESS’s ability to mobilise quickly and deliver market-tested results under demanding time constraints.

Equipment Scope

The portfolio comprised:

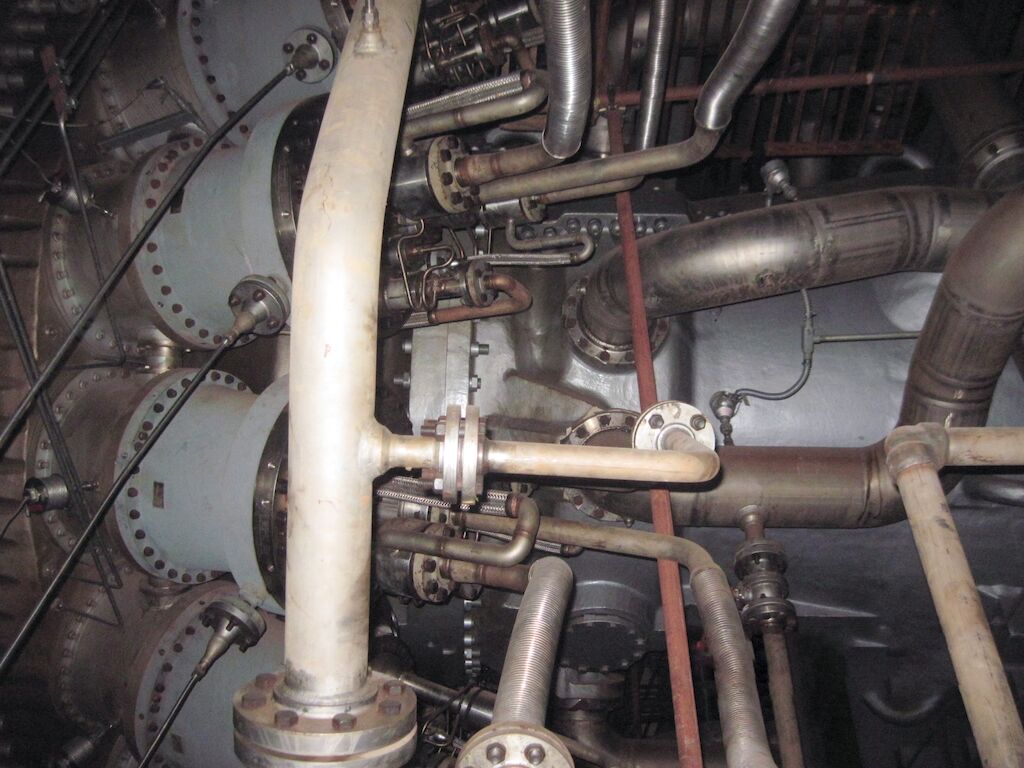

- Aero-derivative CCGT modules based on GE LM6000 gas turbines

- Mid-size combined cycle systems using Siemens V94.2 and GE Frame 6B

- A large-scale combined cycle installation incorporating GE Frame 9FA gas turbines and associated steam turbines, with full mechanical and electrical auxiliaries, maintained in OEM-preserved condition.

Each site included varying levels of balance of plant, with key exclusions (e.g. HRSGs, enclosures, and civils) factored into the final market valuation.

Valuation Approach

All assets were inspected on-site by senior CESS engineers. Fair Market Value (FMV) was determined using a structured methodology based on:

- Technical condition, operating hours, and OEM service history

- Preservation quality for unused equipment

- Overhaul or repackaging requirements

- Relocation feasibility and inland access

- Recent comparable transactions and global buyer appetite

- Excluded components and likely buyer deductions

Commercial Observations

CESS’s valuation was grounded in detailed technical inspection and supported by comparable global sales data to reflect realistic market conditions. However, final pricing strategy is always a commercial decision for the asset owner. In practice, the resale of utility-scale combined-cycle power plants, particularly those exceeding 1 GW in capacity, presents unique challenges.

Opportunities for full-plant relocation are extremely limited due to the logistical complexity, permitting requirements, and capital intensity of re-deployment at this scale. As a result, buyer engagement is typically confined to a small number of developers with specific site conditions and financing in place. When initial price expectations substantially exceed market-supported values, even qualified buyers with real projects may withdraw early in the process, leaving high-quality equipment unsold despite strong underlying condition.

This experience reinforces the importance of aligning commercial expectations with evidence-based valuations, ensuring that well-maintained assets are positioned credibly in a constrained and highly selective global market.

Outcome

- All four sites were inspected across four Indian states within 7 days

- Final valuation report delivered 3 weeks after contract signing

- FMVs supported successful sale of high-demand components

- CESS recommendations led to cost-avoidance via decommissioning of legacy assets with no resale opportunity

Why It Matters

This project demonstrates CESS’s ability to:

- Execute large-scale, multi-site appraisals under severe time constraints

- Bridge engineering diligence with real-world commercial outcomes

- Deliver valuations that help clients avoid wasted marketing efforts

- Inform long-term strategy for underutilised or stranded energy infrastructure

CESS continues to support buyers, developers, and institutional owners globally in positioning assets for real outcomes — not just theoretical potential.